My car insurance price blog 0216

7 Ways To Lower Your Auto Insurance Rates - Ama Things To Know Before You Buy

The biggest discount will take place if you have a work-at-home plan. This will imply that you will have essentially no commute, guaranteeing you will get the biggest discount rate on commuting. 7. Enhance your credit Right or wrong, insurance companies take your credit rating into account when pricing your cars and truck insurance coverage.

Increase your deductible I conserved this one for last due to the fact that it appears on virtually any list of ways to reduce your vehicle insurance premium. However although it's a clich, it's still an extremely legitimate point. In case of a claim, your deductible is the amount of money you accept pay out-of-pocket prior to insurance coverage starts - cheap car insurance.

One caution hereif you have a history of accidents in which you have actually submitted claims, you do not wish to ask for a greater deductible. vans. Considering that submitting claims is relatively predictable, increasing your deductible will simply increase your direct exposure, potentially costing you more cash than you save. auto insurance. Summary There are lots of strategies that might easily decrease your car insurance coverage premium by a number of hundred dollars each year.

Bundle your protections, One of the best ways to save money on automobile insurance coverage is to buy a number of types of coverage from one business, normally referred to as bundling your policies - credit score. Numerous insurance business offer numerous types of coverage, consisting of: Vehicle insurance coverage, Motorcycle insurance coverage, Property owners insurance coverage Renters insurance, Apartment or co-op insurance, Property manager insurance, Flood insurance, Earthquake insurance coverage, Buying two or more policies through the exact same business frequently comes with a substantial discount rate, and bundling policies may imply you can make your payments on both at the very same time, or simply pay one deductible when submitting a claim with both policies. cheap.

If you can pay for to replace your automobile out-of-pocket, carrying just liability protection can save you a substantial amount of cash each year - insurance company. It is essential to do the math before dropping coverage, nevertheless, so ensure you know exactly how much you can manage and work with a representative or other insurance agent to make sure all of your requirements are satisfied. car.

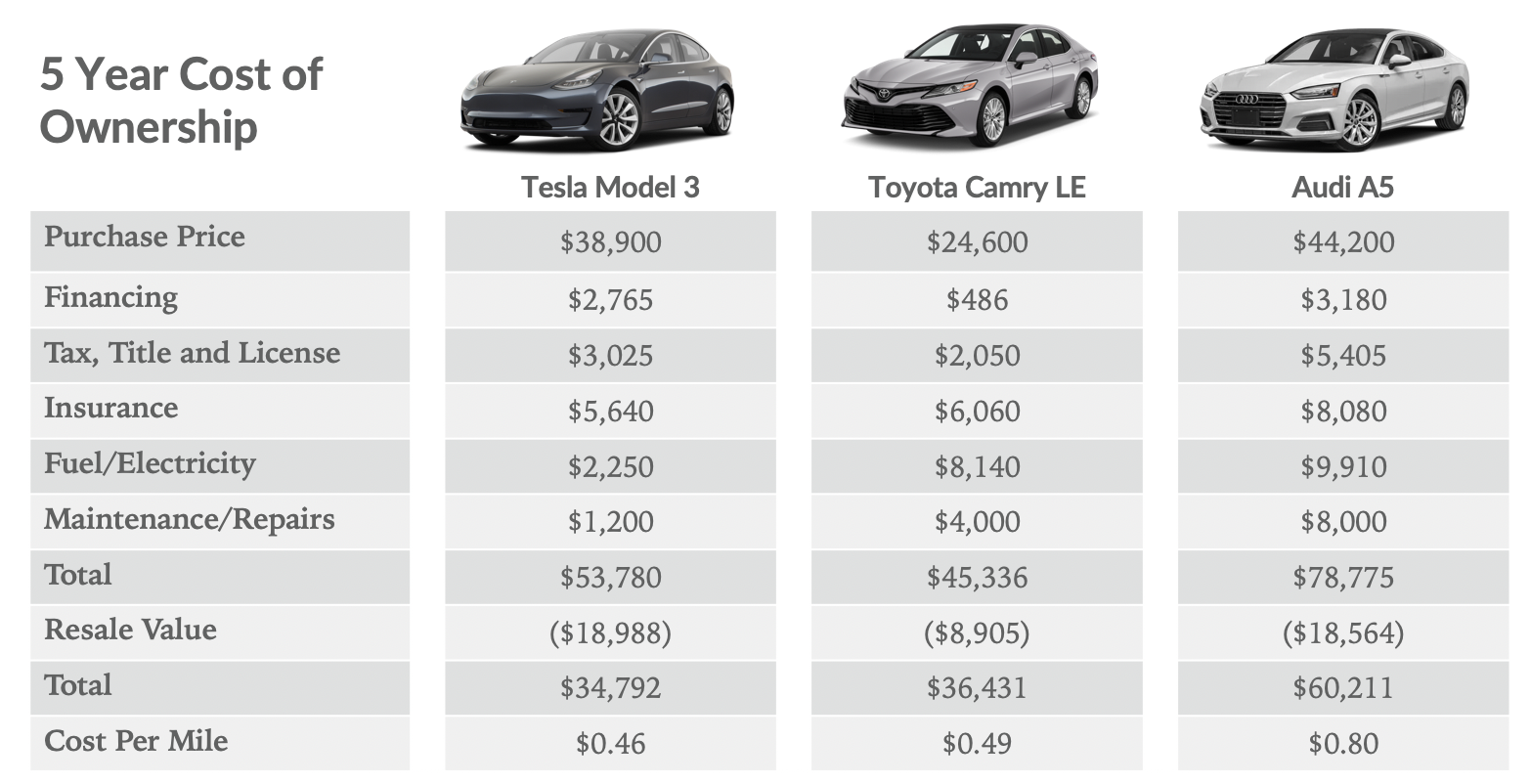

Choose your vehicle carefully, What kind of cars and truck you drive has a big effect on just how much you spend for automobile insurance coverage (affordable). Some cars and trucks are most likely to be stolen than others, which implies comprehensive insurance will be more expensive for those cars. Other cars cost more to repair after an accident, which indicates collision protection will be more pricey for those models.

The Best Strategy To Use For How To Lower Car Insurance Rates: Uncommon Discounts

It isn't simply which specify you live in that effects your rates; moving from one ZIP code to another can possibly alter your rates by numerous dollars each year. dui. The population density of an area, the variety of accidents reported, and the types of parking readily available can all have an effect on your insurance costs.

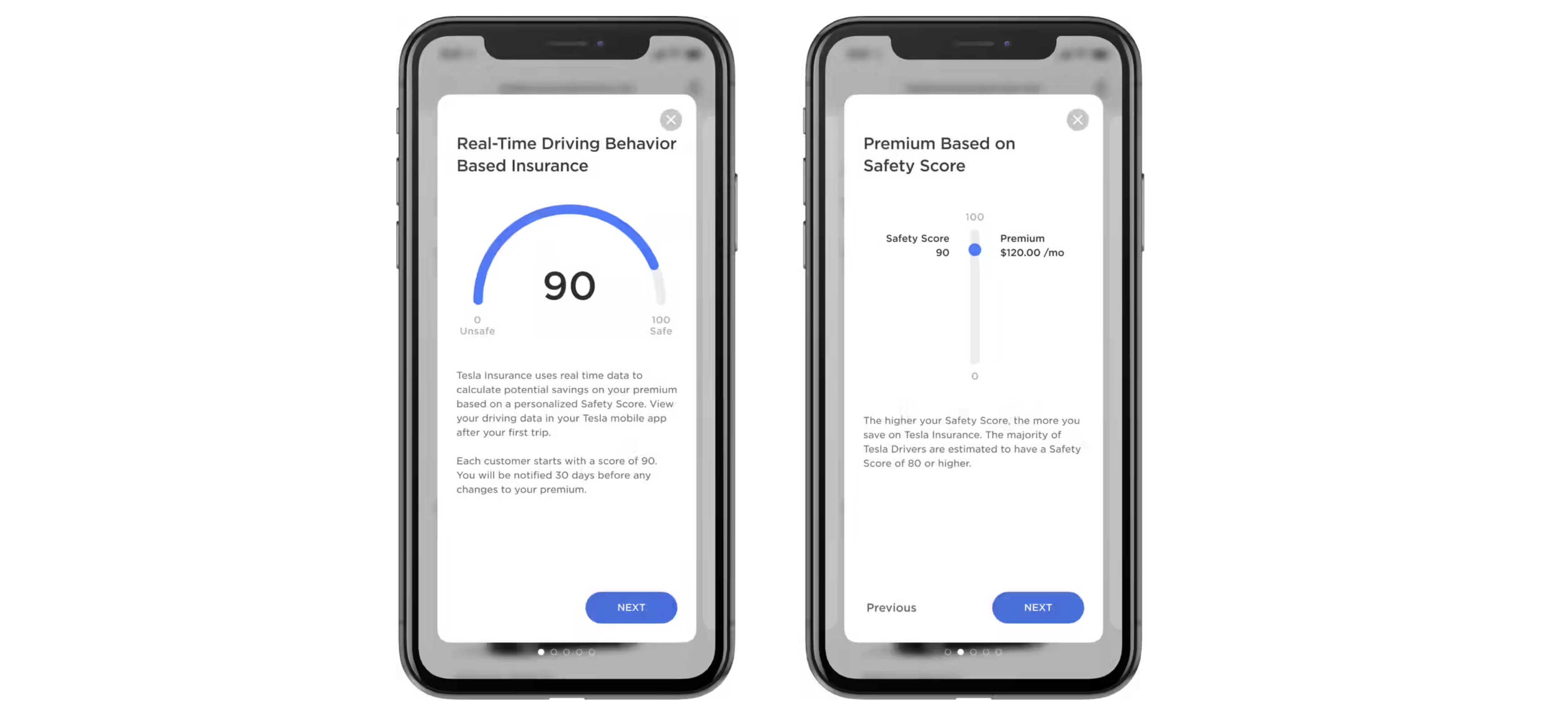

Think about pay-as-you-go insurance coverage, Insurance coverage companies have actually traditionally utilized statistical information to set rates for their clients, but brand-new innovation enables them to set rates based on behavior behind the wheel. Companies can utilize phone apps or devices set up in your cars and truck to track your yearly mileage, your speed, when and where you drive, and other elements that can help them more accurately determine how much you ought to pay for car insurance.

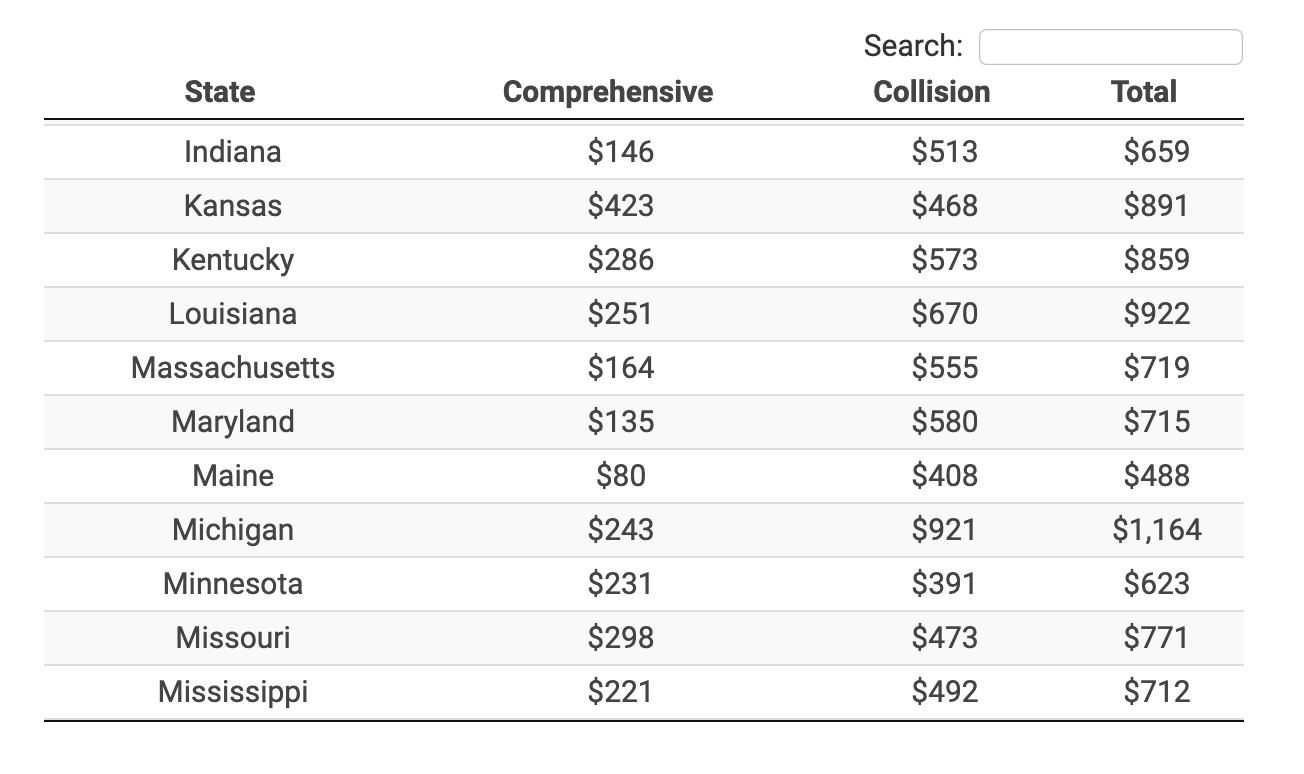

Rates offered are a sample of insurance coverage costs. affordable auto insurance. Your actual quotes might vary.

1. Understand your present protection, The first thing you wish to do is comprehend your current automobile insurance plan. You wish to see where you currently stand, so you can evaluate whether the coverage and limitations you originally bought are still the ideal fit for you. You might have acquired your policy when your way of life was various.

Undoubtedly, each time you start your automobile and get on the roadway, there's a level of danger. low cost auto. Naturally, if you drive less, there's less risk. Why not reward yourself for that and pay less for insurance at the same time? Using pay-per-mile insurance coverage, you can do simply that.

Compare rates amongst car insurance coverage service providers Are you pleased with your car insurance coverage rate? Or do you desire a method to figure out how to lower your vehicle insurance coverage rate?

How 7 Ways To Lower Your Auto Insurance Rates - Ama can Save You Time, Stress, and Money.

Make sure to check amongst numerous cars and truck insurance companies to see potential rates. You can look at traditional vehicle insurance coverage vs (auto). pay-per-mile insurance coverage and assess what is best for your special circumstance. 4. Make a switch and downsize your vehicle Here's something you might not desire to hear. The type The type of automobile you have could be costing you more.

Were to occur, the replacement costs would likely be greater. In addition, expenses can be greater with larger lorries since of the prospective damage done to other vehicles in the occasion of a mishap. If you scale down to a smaller or more fuel-efficient car, your vehicle insurance coverage expenses might be reduced (car insurance).

Increase the deductible, If you have an excellent driving record and really seldom enter accidents, you could increase your deductible to save money on your cars and truck insurance coverage. auto insurance. You usually pay more for vehicle insurance if you have a lower deductible. Your deductible is how much you need to pay prior to your insurance coverage kicks in.

If you increase your deductible, you might wish to consider saving money to make certain your emergency situation fund could cover the difference to prevent any undesirable surprises later on. 6. Request for discounts, An easy way to lower vehicle insurance is to ask for discount rates! (yes, really). It frequently goes undetected, but insurer have various discounts offered depending upon your personal circumstance.

Furthermore, your situation might have altered since you initially purchased your policy, and you might now get approved for a discount rate - auto. A typical automobile insurance coverage discount is a multi-vehicle discount rate if you insure more than one car on the exact same policy - low-cost auto insurance. There are likewise rate decreases available in some states based upon the kind of job you have, whether you're married, or there may be benefits for being a safe motorist.

Think about momentarily altering your protection, Your vehicle insurance policy ought to work for you. Metromile and some other insurance coverage business let you personalize your policies, including your protection limitations and overalls.

The Ultimate Guide To 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

If you're still spending for miles you aren't in fact driving, it's time to re-think your auto coverage. Grab a totally free quote with Metromile today to see your possible savings - accident.

https://www.youtube.com/embed/ByY2FiYYU_g

Some insurance providers offer insurance coverage through business representatives, while numerous go through independent representatives that will offer quotes from numerous business (accident). Other providers will just give rates directly, usually over the phone or online. suvs. Pick Automobiles That are Cheap to Guarantee Before Buying a New Automobile, Whether it is brand-new or used, when selecting your next automobile, compare car insurance rates for the vehicles you are looking at.

All About Cancellation Or Non-renewal Of Your Policy - Missouri ...

Some drivers add it to their policy even when they do not need it - cheaper car insurance. On the various other hand, some prevent including it to their policy even when they require it the many. Rate, Pressure has produced this blog site to help you comprehend how comprehensive insurance policy can save a great deal of your cash as well as when it can be a waste of cash.

What does detailed vehicle insurance policy cover?

What does detailed automobile insurance coverage not cover? Currently comes a fascinating section, we know what thorough insurance covers (risks).

Just how much is thorough automobile insurance price? Currently that you have chosen to add detailed insurance to your plan it's time to examine what will be the expense of comprehensive car insurance policy coverage? The in our country is - cheap. This number can alter as per the firm as well as the place of the vehicle driver.

Likewise, every state has some regulations and ecological factors that affect the insurance price of the drivers because location. Besides that, there are a great deal of other aspects that influence the automobile insurance coverage rate for any type of vehicle driver. As well as every insurance firm thinks about variables like the kind of cars and truck, the age of the vehicle driver, real cash value of the car, and so on.

The 45-Second Trick For Comprehensive Vs. Collision Car Insurance - Money Under 30

Do you require thorough vehicle insurance? As well as if the motorist is intending to get an auto from lending institutions or renters after that thorough car insurance coverage may be mandatory.

If you understand that your cars and truck's actual price worth is lower than the insurance coverage amount you will obtain then there is no factor in wasting your money. Your insurance provider will certainly never ever pay you more than the actual expense value of your car. The first point you have to do is examine your auto's real price value.

The deductible quantity is typically between $500 and $1500 for every motorist in all the states of our country. Allow's recognize this with an instance. If you have actually agreed to a deductible of $800 and also you have actually sued for damages from fire. The insurance policy business will deduct the $800 from your case cash as well as after that will send the cheque.

Insurer use this as their insurance policy - cheaper car insurance. A vehicle driver that recognizes that she or he will certainly have to compensate to $800 for any kind of repair work will drive extra safely. The chances of crashes decrease and also the business saves money. How thorough automobile insurance functions? It is far better to comprehend the procedure of extensive insurance coverage with an instance.

Currently to replace the windscreen you will have to sue. Assume that the substitute cost of the windshield is $3000. Now your deductible quantity will certainly enter the picture. The insurance business will pay the expenditure of replacing the windshield yet the quantity will include your insurance deductible. If your deductible quantity was $500, so the firm will certainly pay you $2500 for the windshield substitute.

The Facts About What Is Comprehensive Insurance? Uncovered

Thorough insurance policy vs full protection insurance Most of the motorists get confused in between comprehensive insurance policy and full protection insurance coverage., crash insurance, and also comprehensive insurance coverage.

Currently when a motorist integrates the accident, comprehensive, and the minimum demands (that is required for each vehicle driver) then it is called full protection insurance policy. credit. On the various other hand, with detailed insurance coverage, the driver will purchase only the state's minimum required insurance coverage and also thorough cars and truck insurance policy. The automobile will be covered from flooding or fire however not from the accident with an additional automobile.

Over to you! Currently we really hope that this blog has aided you to understand the effect and advantage of getting detailed insurance policy. Getting car insurance coverage is not as simple as it looks when you wish to conserve some cash. Either you can just purchase the insurance policy from any business without your study and pay a greater costs.

Cost of Comprehensive Insurance policy Comprehensive covers damages to your car triggered by crashes and disasters past vehicle crashes. affordable auto insurance. The ordinary cost of comprehensive is around $134 per year, according to the Insurance coverage Details Institute.

Either way, you are looking at under $200 a month simply for thorough insurance policy for your auto. If somebody believes they're not likely to file a comprehensive claim, but they don't desire to forego comprehensive insurance coverage entirely, they could choose a fairly high $1,000 deductible to lower the premiums.

How What Is Comprehensive Insurance? - Progressive can Save You Time, Stress, and Money.

As well as thorough insurance might be costly if you are purchasing it together with accident insurance coverage. If your automobile is older and also repaid, you could conserve cash by not acquiring extensive insurance coverage, especially if theft and also weather-related events are not problems where you live. Pros Extensive insurance coverage secures you against burglary, weather-related occasions, as well as various other major things past your control.

If you have a brand-new auto as well as live in a high-crime area, thorough insurance policy will certainly cover the problems created by any break-ins or burglaries. Extensive insurance policy does not cover anything individual stolen from your automobile.

Example of Comprehensive Insurance Comprehensive insurance works similar to any kind of other kind of automobile insurance policy if you need to submit an insurance claim. However if you've never needed to do so, it helps to have an illustration, so you know what to anticipate. Here's an instance of how extensive insurance functions if a chauffeur submits a claim for lorry damages.

Cost of Comprehensive Insurance coverage Comprehensive covers damages to your car created by accidents and disasters past automobile mishaps. The average price of extensive is roughly $134 per year, according to the Insurance policy Information Institute.

In either case, you are checking out under $200 a month just for comprehensive insurance coverage for your car. Collision as well as extensive insurance each have their deductibles (obligation insurance has no insurance deductible), so a vehicle driver can choose various deductibles based on regarded threat levels in each of these areas (car). If someone thinks they're not likely to file a thorough insurance claim, yet they do not want to bypass detailed insurance altogether, they could choose a relatively high $1,000 insurance deductible to decrease the premiums.

Little Known Facts About Comprehensive Car Insurance Policy Online - Hdfc Ergo.

And thorough insurance policy might be pricey if you are buying it along with crash insurance policy. If your lorry is older as well as settled, you can conserve money by not purchasing detailed protection, especially if theft as well as weather-related events are not problems where you live. Pros Extensive coverage shields you against burglary, weather-related events, as well as various other major things past your control (vehicle).

If you possess a new cars and truck and also live in a high-crime location, comprehensive insurance policy will certainly cover the damages caused by any type of break-ins or burglaries. Extensive insurance policy doesn't cover anything individual stolen https://changingcarinsurance.s3-web.ams03.cloud-object-storage.appdomain.cloud/ from your auto.

Instance of Comprehensive Insurance policy Comprehensive insurance policy works similar to any various other sort of vehicle insurance policy if you need to submit an insurance claim. If you've never had to do so, it aids to have a picture, so you know what to anticipate. Right here's an example of how extensive insurance coverage functions if a chauffeur files a case for car problems.

Price of Comprehensive Insurance policy Comprehensive covers damage to your auto caused by crashes and disasters beyond cars and truck crashes. The typical price of comprehensive is approximately $134 per year, according to the Insurance Information Institute.

Regardless, you are looking at under $200 a month just for thorough insurance for your auto. Collision and thorough insurance coverage each have their deductibles (responsibility insurance has no insurance deductible), so a driver can choose different deductibles based upon viewed danger degrees in each of these areas. If somebody believes they're not likely to file a detailed insurance claim, but they do not desire to forego thorough insurance altogether, they could pick a fairly high $1,000 insurance deductible to decrease the costs.

Some Known Details About What Is Comprehensive And Collision Insurance? The ...

As well as comprehensive insurance policy may be expensive if you are purchasing it along with collision insurance coverage. If your automobile is older and also repaid, you could save money by not buying detailed coverage, particularly if burglary and also weather-related occasions are not issues where you live. Pros Extensive protection protects you against theft, weather-related events, and other significant things past your control. cheapest.

If you have a new automobile as well as live in a high-crime area, thorough insurance policy will cover the damages caused by any type of break-ins or burglaries. Comprehensive insurance policy does not cover anything individual swiped from your automobile.

Example of Comprehensive Insurance Comprehensive insurance policy works comparable to any kind of other sort of vehicle insurance if you need to sue. If you've never had to do so, it aids to have an illustration, so you understand what to expect. Right here's an example of how thorough insurance coverage works if a chauffeur files an insurance claim for automobile problems.

Cost of Comprehensive Insurance Comprehensive covers damage to your car triggered by crashes and also disasters past automobile accidents. The typical price of detailed is around $134 per year, according to the Insurance coverage Information Institute.

In either case, you are checking out under $200 a month just for comprehensive insurance policy for your vehicle. Crash and also detailed insurance coverage each have their deductibles (responsibility insurance policy has no insurance deductible), so a vehicle driver can pick various deductibles based upon regarded threat degrees in each of these areas. If a person thinks they're not most likely to file a detailed case, however they don't desire to do away with comprehensive insurance altogether, they could select a relatively high $1,000 deductible to reduce the premiums.

Fully Comprehensive Car Insurance - Comparethemarket.com Can Be Fun For Everyone

And comprehensive insurance may be pricey if you are acquiring it in addition to accident insurance policy. dui. If your car is older and repaid, you might save money by not acquiring comprehensive protection, specifically if theft as well as weather-related events are not issues where you live. Pros Extensive protection shields you against theft, weather-related events, as well as various other significant points beyond your control.

If you possess a new car and also reside in a high-crime area, extensive insurance coverage will cover the problems triggered by any break-ins or burglaries. Disadvantages Thorough insurance does not damage brought on by an accident. It may not be required to have for an older auto with high gas mileage. Extensive insurance policy doesn't cover anything individual taken from your automobile.

https://www.youtube.com/embed/Jt3olmyzaks

Instance of Comprehensive Insurance Comprehensive insurance coverage works comparable to any type of various other sort of vehicle insurance policy if you need to submit a case - car. If you've never had to do so, it aids to have an image, so you understand what to expect. Below's an example of exactly how detailed insurance coverage functions if a motorist sues for lorry damages.

A Biased View of How Much Auto Insurance Coverage Do I Need?

For those factors, you may desire to raise your protection to greater bodily injury responsibility limits and higher home damages liability restrictions: $100,000 each, approximately $300,000 a mishap for medical costs for those injured in an accident you create, and also $100,000 for home damages that you trigger. For cost-conscious customers with older cars, it might not be worth the cash to guarantee against damage to your vehicle. cheapest car.

If your vehicle deserves much less than 10 times the premium that you are spending for these added coverages, acquiring these coverages might not be inexpensive. If you take this route, be prepared to pay for all related losses out of pocket."Just how do I reduced cars and truck insurance policy prices? Take into consideration following these tips to decrease the expense of cars and truck insurance coverage without compromising coverage (vehicle insurance).

You can call firms straight, access details online or work with an insurance representative who can obtain the quotes for you and aid you contrast."Maintain a tidy driving record as well as Click for info inspect your driving document for precision, repair any kind of errors. Inspect safety and security scores as well as purchase a vehicle that's taken into consideration risk-free by insurance policy firms.

Has showed up usually on Greetings America appearances, Shopping for automobile insurance policy is like purchasing for anything else. You need to always contrast prices," Bodge claims. "There are a lot of providers around, as well as while they commonly take into consideration variables like your age, driving background, kind of vehicle, and so on, rates can vary widely from service provider to provider.""As soon as you pick an automobile insurance policy service provider, this is not your company forever.

Instance in point, my other half and I were with the same carrier for many years. We thought that we were obtaining the finest rate, like we were when we first subscribed, once we looked around, we realized we can do a lot far better. Also, if your credit rating enhances gradually, you might receive an extra positive automobile insurance rate".

The What Is Full Coverage Car Insurance? - Auto - Usnews.com Diaries

That indicates you have a suggestion of what you'll pay without having to offer any kind of personal information (prices). Nevertheless, when getting real quotes from insurance provider, you'll typically have to supply at the very least the following: Your permit number, Car identification number, Your address, or where the car is kept when not on the road, Regularly asked questions while estimating car insurance coverage expenses, You've obtained extra questions? We have the solutions.

org, Powered by An And Also Insurance coverage, She suggests customers when searching for insurance coverage prices estimate to ask a great deal of concerns, as well as if you're talking with a broker, permit yourself adequate time on the phone to obtain the correct descriptions and information regarding your plan. When contrasting vehicle insurance coverage prices, it is very important to take a look at the rate, make certain the insurance coverages match with every quote so you are comparing apples to apples, as well as have a look at the insurance firm's credibility," Mckenzie claims - low-cost auto insurance.

vehicle insurance auto insurance vans car

vehicle insurance auto insurance vans car

And also was the MVR (motor car record) run on each quote, What are the factors that influence car insurance coverage prices? A selection of score elements identify just how much you will pay for cars and truck insurance.

Kind of auto, Age & years of driving experience, Geographic location, Marital condition, Driving document, Yearly gas mileage, Credit background, Chosen coverage, limitations and deductibles, Why some cars are less costly to insure than others? Vehicle insurance companies track which cars have the most accidents and also the most awful injury documents. perks. Those elements impact the price you spend for obligation insurance coverage-- which covers the damage you trigger to various other as well as not the damage to your automobile.

Those elements drive up the cost of accident and comprehensive insurance coverage, which repair work or changes your very own auto - cheaper. The computations regarding the risk of a particular vehicle are made independently. If you are an inexperienced driver in a cars and truck with an inadequate cases document, you are penalized twice.

Little Known Facts About What Is Full-coverage Car Insurance? - Jerry.

The less experienced the vehicle driver, the greater the prices (cheap auto insurance). That's due to the fact that statistically, inexperienced motorists crash a great deal and so they are the riskiest category of chauffeurs to insure. Cars and truck insurance rates show this high risk. Obviously, the substantial bulk of unskilled chauffeurs are teens and also those under age 25.

All of this helps insurance companies discern the risk linked with insuring your car in that ZIP code, whether you ever have made an insurance claim or not. Just how does my marriage condition influence my auto insurance coverage price?

Yet there are also various other cars and truck insurance policy discount rates couples can look ahead to when they incorporate their policies, such as a multi-car discount, or a multi-policy discount if they have a tenants or property owners policy with the exact same insurance firm. An insurance firm considers you single if you have actually never ever been married, or are widowed or divorced (laws).

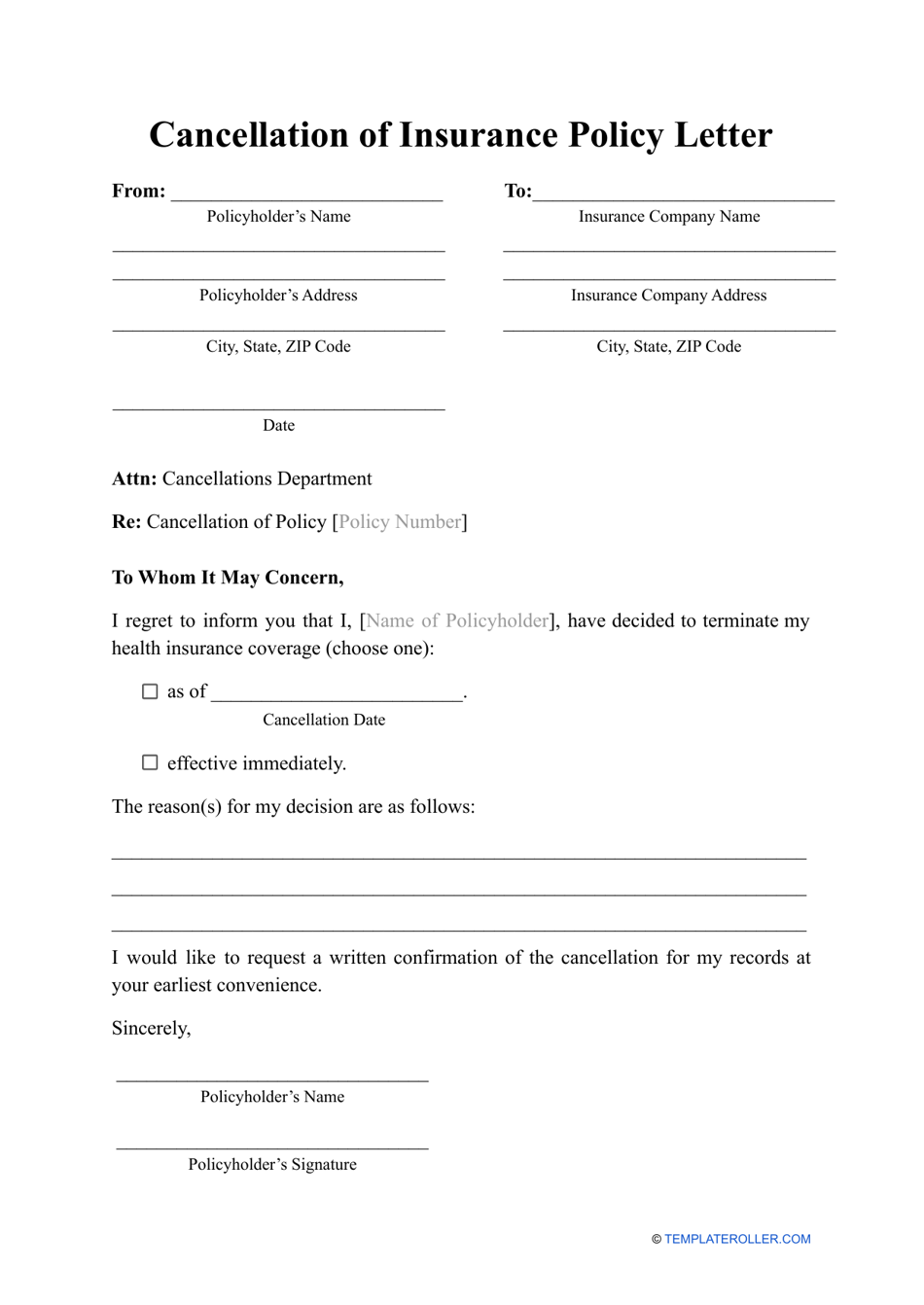

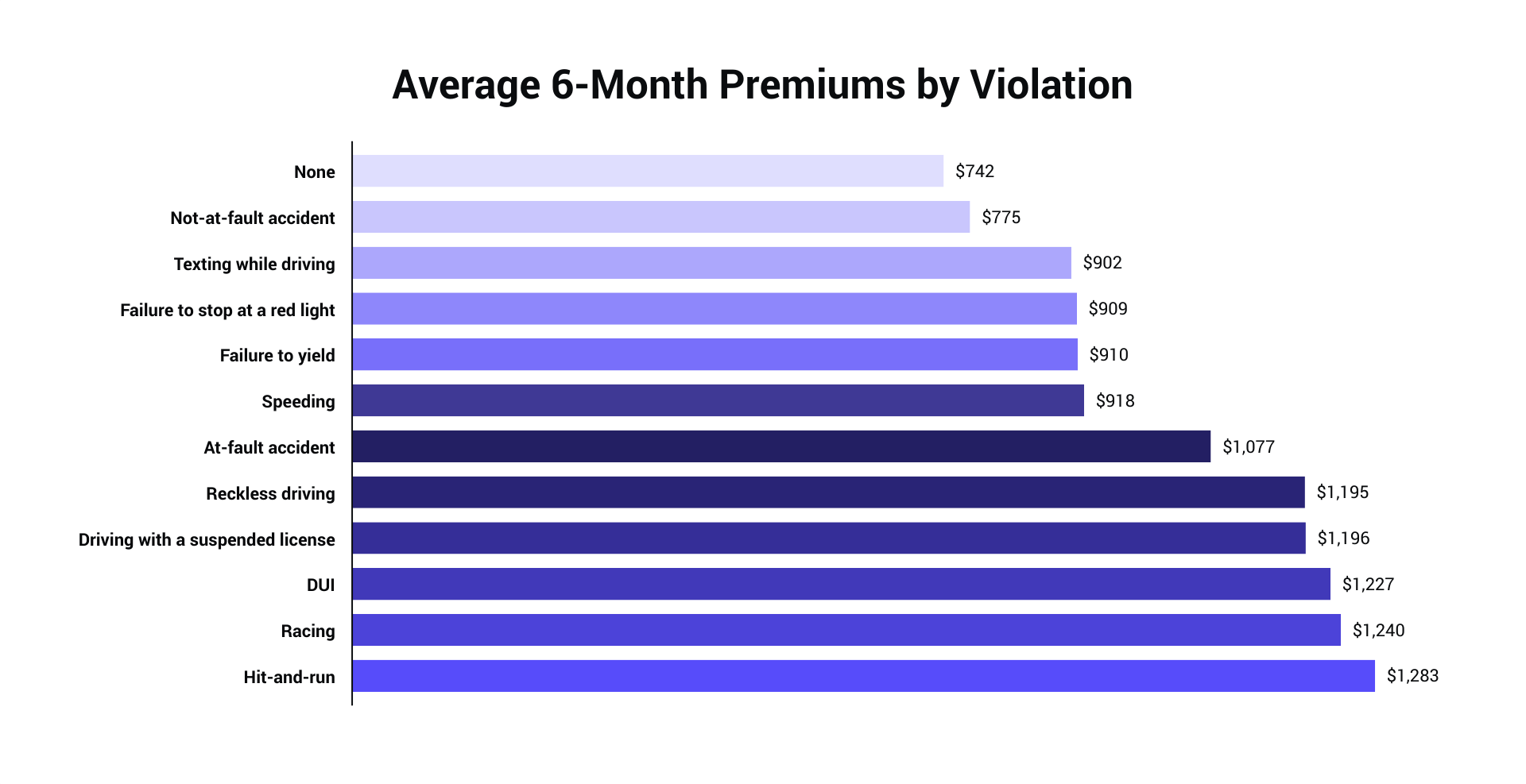

For instance, some insurance companies deny any individual with 4 or even more chargeable accidents in 3 years, or greater than 3 DUIs in seven years, or even more than 15 points on the motorist's automobile document. As a whole, a minor violation such as a speeding ticket can improve your prices, typically, by 25% to 43%.

5% much less, on average, contrasted to chauffeurs with longer commutes, a Vehicle, Insurance. Just how does mileage impact car insurance coverage prices? If you drive 12,000 miles a year, or less, your insurance coverage firm will usually think about that to be lower than average, as well as you'll likely pay a reduced price than those that drive more than that.

Getting The Cheap Full Coverage Car Insurance To Work

To get the very best low-mileage discounts, which have to do with 7% typically, you generally should drive under 7,000 or 5,000 miles annually. Based upon a Los Angeles motorist with a complete protection policy, the expense of a plan when the vehicle driver logged 20,000 or more miles was 12% more costly than if simply 5,000 miles were driven a year (car).

We asked Charles, the adhering to inquiries about credit report background and insurance coverage rates: What are the advantages and disadvantages of utilizing a motorist's credit report when establishing auto insurance rates? Determining as well as awarding vehicle drivers with excellent credit practices can yield consistent income and also company stability for insurers. A customer's credit report says a great deal concerning them (affordable car insurance).

In the lengthy term, insurer's development can be limited if some customers are valued out of the market, this can have a cascading effect where reduced sales cause decrease profits as well as lower ROI. It may be best to take computed dangers and make policies offered at affordable prices to those with lower credit history.

Insurance companies are all about threat as well as numbers, and if their research states that people with poor credit score are commonly negative vehicle drivers, one could make the argument that charging higher risks is practical. Even if it type of really feels like the insurer is kicking the individual with negative credit history while they're down.

Customers with reduced credit report sometimes will not get approved for month-to-month invoicing, or they might require to pay a huge percent of the policy up front and the remainder monthly (cheapest). All the same, fair or not, credit history usually do have an effect on one's insurance costs. If you desire them to go down, it makes sense to try to make your credit rating go up.

3 Easy Facts About Unitedhealthcare: Health Insurance Plans For Individuals ... Explained

The more insurance coverage you get, the extra you will certainly pay. If you get a bare-bones obligation plan that covers just what the state calls for, your cars and truck insurance policy prices are mosting likely to be less than if you bought insurance coverage that would certainly repair your very own car, as well. Liability coverage has a tendency to cost more due to the fact that the quantity the insurance policy firm threats is greater - liability.

If you don't have adequate obligation insurance coverage, you might be taken legal action against for the difference by anybody you harm. The higher the insurance deductible, the much less the insurance coverage firm will have to pay-- and the lower your rates.

Without some sort of clinical protection, if you don't have medical insurance somewhere else, you might not have the ability to spend for treatment if you are injured in an accident you created. One way some chauffeurs can restrict their insurance costs is with pay-as-you-drive insurance. This kind of insurance coverage bases the expense of your costs on exactly how much you drive, as well as might take right into account other driving routines.

Otherwise, these vehicle drivers "pay approximately the exact same yearly dealt with costs for insurance as one more vehicle driver with high annual mileage."Exactly how much is automobile insurance policy per year? Here's exactly how much the average driver, with great credit and also a tidy driving record, would certainly pay for the complying with protection amounts, based on Cars and truck, Insurance.

The typical price for 50/100/50 is. The average price for 100/300/100, with detailed as well as collision and a $500 deductible is. Bumping state minimum as much as 50/100/50 prices just $129, so it's just around $11 a month-- Going to 100/300/100 from 50/100/50 expenses, to increase your obligation security (suvs).

The 30-Second Trick For Florida Car Insurance 101: What Does Full Coverage Mean?

These theoretical vehicle drivers have clean records and excellent credit scores. Average prices are for relative objectives - cars. Your own rate will certainly depend upon your personal variables and car.-- Michelle Megna contributed to this article.

In almost every state, at the very least some amount of vehicle insurance coverage is required by legislation to obtain behind the wheel. Being lawfully required, cars and truck insurance is vital to maintain you shielded from the monetary concern of an array of negative points that can take place in, around, and also to your vehicle.

insure insurers vans low-cost auto insurance

insure insurers vans low-cost auto insurance

We'll damage down just how we price Lemonade Cars and truck plans, so you can obtain the truths and also obtain the coverage you require with confidence. The most uncomplicated method to get a sense of how we price Lemonade car insurance is by obtaining protection. liability. It's quickly, easy, and also straightforward to compare.

Choosing a greater insurance deductible will normally cause lower costs, since it indicates you would certainly be accountable for more of the preliminary prices in the occasion of a mishap. What the expense of Lemonade Cars and truck covers If you wish to take a deep dive right into every one of the protection kinds offered by Lemonade Cars and truck, we've got you covered here.

https://www.youtube.com/embed/Kg-QAwrIqKY

If you have an interest in discovering more concerning a plan with Lemonade Vehicle, the most convenient method to explore your coverage optionsand what you would certainly payis by making an application for a quote (liability). It's fast, easy, and also also a little enjoyable.

The Best Guide To Honda Roadside Assistance - Honda Owners Site

Edit your About page from the Pages tab by clicking the edit button.

All about Honda Roadside Assistance - Honda Owners Site

Edit your About page from the Pages tab by clicking the edit button.

See This Report about Is Roadside Assistance Worth It? - American Family Insurance

Edit your About page from the Pages tab by clicking the edit button.

Everything You Need To Know About Aaa Roadside Assistance for Dummies

Edit your About page from the Pages tab by clicking the edit button.

Fascination About Roadside Assistance Service - Safeco Insurance

Edit your About page from the Pages tab by clicking the edit button.

The Greatest Guide To What Does Progressive Roadside Assistance Cover?

Edit your About page from the Pages tab by clicking the edit button.

5 Easy Facts About Rideshare Insurance Shown

Edit your About page from the Pages tab by clicking the edit button.

All About What Is The Cost Of Commercial Auto Insurance For Small ...

Edit your About page from the Pages tab by clicking the edit button.

The Single Strategy To Use For Rideshare Insurance For Lyft And Uber: What Are The Options?

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on Commercial Auto Insurance: Get 100% Free Quote - Next

Edit your About page from the Pages tab by clicking the edit button.

Little Known Questions About Insurance Requirements For Doordash, Grubhub And Uber ....

Edit your About page from the Pages tab by clicking the edit button.

The Single Strategy To Use For Insurance Coverage While Driving With Lyft

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on Boat Insurance Coverage, Us Boat Insurance - Orchid Insurance

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Boat Insurance That Nobody is Discussing

Edit your About page from the Pages tab by clicking the edit button.

The Facts About Fis-pub 6370 - Boat Insurance - State Of Michigan Revealed

Edit your About page from the Pages tab by clicking the edit button.

Not known Facts About How Are Boats And Watercrafts Insured In California?

Edit your About page from the Pages tab by clicking the edit button.

How Navigating Boat Insurance can Save You Time, Stress, and Money.

Edit your About page from the Pages tab by clicking the edit button.

A Biased View of Boat Insurance Guide: Costs, Coverage & Policies

Edit your About page from the Pages tab by clicking the edit button.

Top Guidelines Of What Car Insurance Companies Don't Tell You About Rates

Edit your About page from the Pages tab by clicking the edit button.

Things about Is There A 5g Network Near You? - Consumer Reports

Edit your About page from the Pages tab by clicking the edit button.

4 Simple Techniques For Best Cheap Car Insurance Companies For April 2022 - Cnet

Edit your About page from the Pages tab by clicking the edit button.

The Best Strategy To Use For Cheapest Car Insurance Companies In 2022 (As Low As $75 ...

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Esurance Car Insurance Quotes & More That Nobody is Talking About

Edit your About page from the Pages tab by clicking the edit button.

A Biased View of Cheap Car Insurance: Affordable Auto Insurance

Edit your About page from the Pages tab by clicking the edit button.

How Total-loss Thresholds By State - Carinsurance.com can Save You Time, Stress, and Money.

low cost suvs car insurance perks

low cost suvs car insurance perks

It would not deserve it to conserve a little cash for an automobile that is not safe to drive (auto insurance). You should likewise recognize that when the repair services are total, you'll have to obtain an examination to make sure that the cars and truck's title will certainly be transformed from "salvage" to "rebuilt." Why? You could have problem discovering an insurance provider to insure a vehicle with a rebuilt title - car insurance.

insurance affordable auto cars auto

insurance affordable auto cars auto

The financial institution or money firm will figure out whether you can keep the auto in the end. Deciding If after seeing all these options, you are still uncertain what to do, the most effective point would be to identify the benefits and drawbacks of either letting your insurance firm overall your vehicle, appealing their decision or attempting to keep and fix your very own cars and truck.

vans vehicle insurance vehicle insurance car insured

vans vehicle insurance vehicle insurance car insured

If you have the time and energy to appeal your insurance firm's decision to total your vehicle as well as would experience significant problems without an auto, then this choice could be worth pursuing. When it comes to maintaining and also repairing your car, this can be a pretty extensive undertaking (automobile). If you are an auto mechanic or have a few other way to get truly economical parts as well as repair service work done on the cars and truck.

If, alas, you actually can not appeal the choice or it does not make feeling to keep and also fix your vehicle, then you could just have to approve the insurance firm's choice to complete the auto. Regardless, it's vital to recognize that you have choices if this ever before takes place to you.

Expense of Repair Work > Actual Cash Value = NOTICEABLE COMPLETE LOSS 100% Expense of Repair @ 70% of ACV + Salvage Worth > Actual Cash Money Value = CONSTRUCTIVE FAILURES If the cost to repair service is greater than the automobiles ACV at the time of loss, the automobile will be declared an obvious failures. cheapest auto insurance.

Unknown Facts About The Insurance Company Totaled My Car. What Now? - Nolo

There are lots of concerns pertaining to the worth of cars and you Go here might have concerns concerning the value of your car in a failure situation. low-cost auto insurance. Depending on your insurance firm, the worth of your lorry is determined based upon the pre-accident problem of the automobile, the number of kilometres on the odometer, the choices readily available on the lorry and also any kind of damages that was not brought on by the mishap. accident.

If the car is funded, we will certainly function with you to establish the manner in which we need to proceed - cheapest. If the finance firm has status on your plan, settlement will be co-payable to you the insurance policy holder, and also the finance company - accident. If your lorry is a total loss as well as you have rental reimbursement protection through CAA Insurance policy, we will certainly spend for your rental automobile based on your policy limitations. vehicle.

They may likewise give you with advice regarding when you ought to begin looking for a substitute automobile, so make certain to ask your insurance adjuster if you have any inquiries - insurance company. Please note that the information supplied over is general-purpose info only - cheaper car. It does not prolong your policy insurance coverage beyond that which is created in your plan. auto insurance.

What Is Overall Loss Vehicle Insurance Policy? If you enter into a mishap and also the expense to fix your vehicle is even more than its actual cash value (ACV), your cars and truck insurance policy firm will consider it a failure. It's also a failure if it can't be repaired in all. Complete loss cars and truck insurance coverage implies you have the right insurance coverages to assist you spend for a new car if yours obtains totaled - car insurance.

insurance companies insured car cheap cheaper car

insurance companies insured car cheap cheaper car

Some utilize a failure limit, which can differ in between 50% as well as 100%. For instance, in Arkansas, the overall loss threshold is 70%. This suggests your cars and truck is proclaimed a total loss if the damages are more than 70% of its value. If your car is worth $6,000 and sustains even more than $4,200 in problems, your insurer will certainly consider it an overall loss.

7 Simple Techniques For Car Insurance Wants To Total My Car: What Are The Options?

automobile prices vehicle insurance low cost auto

automobile prices vehicle insurance low cost auto

Get the names of any type of witnesses along with their address and also phone number. Do not consent to forget the accident (vehicle insurance). You may have hidden damages, unknown injuries or later on discover that a lawsuit has actually been submitted against you. Call your representative if you have any kind of questions or interest in the cases process.

The insurance provider might suggest a fixing store; however, you deserve to select the repair shop of your finding (accident). The amount established by the insurer to be payable under the policy, will certainly be paid no matter whether you make use of the advised fixing solution - cars. No insurance provider will need the usage of after-market parts unless the component amounts to the original part in terms of fit, top quality, performance as well as guarantee. cars.

https://www.youtube.com/embed/ueqV1rr7YWE

For that reason, if you as well as the insurance business can not concur on the worth of your claim you may want to seek lawful advice. Suppose the insurance business and I can not concur on the quantity to be paid by my accident or various other than crash (Comprehensive) insurance coverage? You can choose to use the assessment stipulation of your policy - low cost.

The 2-Minute Rule for Does Car Insurance Go Down At Age 25? - Valuepenguin

credit insurance company cheap insurance auto

credit insurance company cheap insurance auto

Full insurance coverage plans include additional coverage on top of state minimum requirements. affordable car insurance.

The prices listed below reflect national averages for minimum coverage, so real rates can differ commonly by state. As lots of new chauffeurs have found, being young is an easy method to pay even more for automobile insurance policy.

Second, research studies have revealed more youthful chauffeurs are far more likely to be in accidents. This causes the high standard vehicle insurance coverage rates for young vehicle drivers in the graph below. These rates are for individual insurance policy plans, which are typically greater than prices for family policies with new vehicle drivers. However, the crash price for young motorists aids clarify why automobile insurance for 20-somethings can put such a dent in your budget.

/images/2020/04/28/car-insurance-rates.jpg) vehicle insurance auto insurance insured car auto insurance

vehicle insurance auto insurance insured car auto insurance

Still, even if your state does not enable business to base prices on age, you may pay more when you're young. If you have actually been driving for just a year or 2, you're most likely to pay more than somebody who has been behind the wheel for a decade.

Our analysis discovered that beginning at age 20, men pay greater typical insurance policy rates. By age 30, females as well as males pay virtually equal rates, but the rate void never truly shuts.

Some Known Details About At What Age Do Car Insurance Premiums Go Down?

Younger males are also more susceptible to fatal mishaps, with prices for male vehicle drivers ages 16 to 19 virtually two times those for female vehicle drivers of the exact same age. Deadly collision rate per 100 million miles driven, Numbers from the IIHS based on evaluation of the united state Department of Transportation's Fatality Analysis Coverage System 2017 information.

By age 30, this distinction drops to just 2%. Again, this information is based upon a nationwide standard of the 5 greatest car insurance companies, so automobile insurance policy prices in your state might be a lot lower. It is among the factors we constantly recommend looking around to contrast auto insurance policy prices. low cost auto.

Some treatment more about your driving history, while some treatment much more about the automobile you drive - insurance. Vehicle insurance provider are additionally limited by regulations for setting automobile insurance rates that vary in each state. States right alongside each various other can have big swings Check out here in average expenses due to neighborhood regulations.

Cross the line right into Georgia, which exact same driver gets an average rate decline of over $1,000, down to $1,698. Therefore, where you live is one of the greatest consider the price you ultimately pay. To get a suggestion of what to expect, have a look at ordinary auto insurance rates in your state.

dui affordable vans cheapest car

dui affordable vans cheapest car

This means when applying for automobile insurance coverage, they might ask for your gender, when they truly indicate sex. They might likewise ask for recognition that doesn't reflect your gender accurately.

Not known Factual Statements About How To Save On Your Teen's Auto Insurance - Cbs News

Finding out to drive is a coming-of-age turning point for numerous teenagers, and paying for a young chauffeur will certainly almost constantly elevate your rates. Yet at what age will your cars and truck insurance policy go down? Age is the most significant consider identifying your automobile insurance rates. Keep reviewing to discover when automobile insurance coverage rates generally drop and what you can do to reduce them, outside of having one more birthday.

And bear in mind that despite your age, you should constantly compare auto insurance policy estimates from numerous carriers so you can discover the very best insurance coverage and rate for you. Use our tool listed below or give our group a phone call Motor1's designated quotes group at to secure free, customized quotes seven days a week - laws.

But insurance providers respect just how knowledgeable you are, so you'll most likely see an extra significant decline around your 25th birthday. Inevitably, the more years on the roadway you have, the lower your costs will likely be. If you're a young driver or the moms and dad of a teen, you might be questioning when you can get some remedy for high auto insurance prices.

Your insurance supplier will check out the number of years you've been driving and your driving record recently. This will certainly aid identify any type of modifications in your costs. As you get experience as well as continuously drive without mishaps or tickets, you're more probable to see a reduction in your car insurance rates.

Cars and truck insurance policy rates are determined by the amount of danger a vehicle driver postures to an insurance provider. This threat is determined by ordinary vehicle driver statistics. Insurance provider desire to shield themselves, so they bill a higher rate for drivers that are more probable to obtain into a crash, sue, or get a moving infraction.

More About Why Do Car Insurance Premiums Go Up Every Year

16- to 19-year olds are virtually 3 times most likely to be in a fatal collision than vehicle drivers age 20 as well as older. auto insurance. They have much less experience driving, so they are most likely to have a mishap typically. Collisions with teen motorists in America are frequently the result of the following: Inexperience with driving Sidetracked driving Driving with various other teenage passengers Impaired, careless, or sluggish driving Driving at night Although that teenagers pay more than adults for high-risk vehicle insurance, you can still go shopping around for prices within your spending plan.

low-cost auto insurance cheaper auto insurance car low cost auto

low-cost auto insurance cheaper auto insurance car low cost auto

To save money on vehicle insurance coverage, many households consider registering teenagers in safe driving programs or vehicle drivers ed training courses. These programs are developed to inform motorists when they are succeeding, in addition to where to make modifications to enhance safety. cheapest car. The majority of insurance coverage firms offer price cuts to teens that complete these programs effectively as well as show indicators of safe, accountable driving.

Utilize our device below or call us at What Else Influences Your Auto Insurance Policy Rate? In addition to age and driving background, below are some other points that can affect ordinary car insurance policy rates: Sex Area Marital condition Debt score Type of vehicle you're guaranteeing Safety and security attributes on your car While many factors like age and also gender are out of your control, there are still several points that could qualify you for lower rates.

That's since they are reasonably low-cost to repair and also much safer on the roadway. On the various other hand, international and also luxury vehicles are thought about a high-risk for auto insurance coverage firms because components are costly. These cars are also extra at risk to theft and also reckless driving. Lots of vehicle drivers see declines in auto insurance rates after they get a lot more driving experience, avoid obtaining tickets, and also avoid crashes.

This two-year driving background may not be long enough to show to insurer that you have reduced your threat. To keep a clean driving document, keep these safe driving pointers in mind: Limit the number of various other teen passengers and diversions. Never drive with your phone in your hand or while consuming. insurance affordable.

The Ultimate Guide To Teen Drivers - Nc Doi

Our Recommendations For Automobile Insurance Policy Regardless of your age, you ought to shop around to find the best vehicle insurance rates. money. We examined the top insurance providers in the nation to identify which is the ideal in customer complete satisfaction, sector online reputation, cost, protection options, discounts, and extra.

Your age effects your automobile insurance policy prices. How do your prices contrast to various other chauffeurs your age? Why young drivers pay so much for insurance Young motorists under 25 years of ages are typically viewed as high-risk by automobile insurance suppliers. The key factor for this is their absence of experience behind the wheel - cheapest car.

The expense of teen vehicle driver insurance coverage is specifically expensive. According to the National House Traveling Study, the accident price per mile was 1 (suvs). 5 times higher for 16-year-old vehicle drivers than it was for 18- to 19-year-old drivers. Across the range of high-school-age chauffeurs, 32. 8% of them have actually texted or emailed while driving.

Auto insurance provider use lots of sorts of discounts that can cut a significant amount of cash off of your annual costs: you'll desire to capitalize on all the discount rates you can discover to obtain that high costs down. An usual discount readily available to young drivers is the excellent pupil discount.

0 or even more, you can see a discount rate on your yearly car insurance costs anywhere from 7% to 25%., numerous providers enable you to add a kid to your auto insurance. On the drawback, adding a kid to your very own vehicle insurance coverage policy will cost you a standard of $278 a month additional. insurance affordable.

Little Known Facts About 9 Ways Retirees Can Whittle Down Their Car Insurance Costs.

, ask your vehicle insurance policy service provider concerning a discount rate. Automobile insurance firms generally discover couples to be much safer drivers and also incentive that reduced danger with a price cut. Having several motorists or numerous vehicles on your policy may decrease general costs., several auto insurance policy firms offer a senior price cut.

If you take the class and pass, cars and truck insurance policy companies may offer you a risk-free driving discount., look into raising your deductible. The higher your deductible, the reduced your automobile insurance costs typically is. This would suggest paying a lot more in deductibles if you do have a mishap. Decreased driving on your component indicates less of an opportunity of having a mishap, as well as as a result paying a deductible (laws).

All web content as well as services offered on or with this site are provided "as is" as well as "as offered" for use. Quote, Wizard. com LLC makes no depictions or guarantees of any type of kind, share or suggested, regarding the procedure of this website or to the details, material, products, or products included on this site.

Some firms, such as Nationwide as well as Progressive, offer more appealing discounts when you transform 25, however this is not the norm. Auto insurance rates are typically greater for young motorists, so searching is a good idea since service providers use varying prices. It isn't shocking, though, that most individuals assume 25 is when insurance coverage prices decrease.

Although a lot of people believe that 25 is the age when auto insurance policy rates drop, the most significant reductions take place when chauffeurs transform 19 and also 21. Rates proceed to reduce until you transform 30 after that, they have a tendency to stay roughly the same - auto. The only time costs begin to raise again will be when you end up being an elderly driver.

Not known Facts About Your Guide To Automobile Insurance - State Of Michigan

According to the National Freeway Traffic Safety and security Administration, male drivers are a lot more most likely to be associated with deadly crashes due to speeding and drive cars that set you back even more to guarantee. An FBI record additionally found male vehicle drivers are twice as most likely to be arrested for extreme driving violations like DUIs.

A prime instance is driving experience. If 2 26-year-old chauffeurs purchase cars and truck insurance policy, with one just having actually begun driving a month ago while the other has been behind the wheel considering that they were 16, you'll see a substantial distinction in their costs. The former is less experienced, and also providers will certainly consider them riskier to insure, causing greater automobile insurance coverage rates. low cost.

Marriage Standing, Insurance suppliers see married motorists as more monetarily stable and more probable to drive securely than those that are not, despite whether they are single, wedded or widowed. Wedded people are additionally more most likely to put both their cars under a single plan, making them eligible for multi-car discount rates.

D. results in lower auto insurance rates. Studies have actually shown that drivers with higher educational achievement are much less likely to file cases than those without postgraduate degrees. Job, Vehicle insurance coverage suppliers usually consider your chosen career when setting premiums but may utilize different logic when computing rates. If you are an exec, one service provider may charge a greater price given that you invest even more time on the road, enhancing the chances of a crash.

Debt History, Studies have actually revealed that drivers with inadequate debt are most likely to submit cases, resulting in much more costly automobile insurance coverage rates. Area, Where you live contributes to the expense of your costs. Vehicle drivers from more booming areas with greater criminal offense rates tend to spend a lot more on auto insurance policy (automobile).

Get This Report about Why Men Pay More For Car Insurance Than Women - Driving.ca

Exactly how Drivers Under 25 Can Pay Less for Auto Insurance, Cars And Truck insurance for a 25-year-old can be expensive. Taking these actions can help young vehicle drivers lower their insurance policy costs as well as obtain more budget-friendly premiums.

https://www.youtube.com/embed/gWSQst8vFCA

You can typically obtain a price cut if you finish a protective driving program. DISCOVER MORE ABOUT SAVING ON Auto INSURANCEAlthough vehicle insurance policy rates are greater when you're younger, there are sensible methods to lower them.

The Ultimate Guide To Best Credit Cards For Car Rentals Of May 2022 - The Balance

95 per rental duration (not daily) to access two various degrees of key insurance coverage. This will normally be a much far better bargain than the rental business's collision damage waiver, and also the protection used is much better than any one of the cards over - cheapest auto insurance. Rentals as much as 42 successive days$75,000/$100,000 in insurance coverage for damages to the rental automobile$7,500/$15,000 in clinical expense insurance coverage each in your cars and truck$50,000/$100,000 accidental death or dismemberment benefit for the cardholder$5,000/$10,000 unexpected fatality or dismemberment benefit for any kind of guests in the cardholder's automobile, Leasings in Australia, Ireland, Israel, Italy, Jamaica, as well as New Zealand, Specific specialized cars, Any type of infraction of the car rental contract, Caveats, Photo by thegiffaryIt must go without claiming, however the very best rental auto insurance worldwide is no alternative to driving safely, wearing your seat belt, and following all regional traffic regulations (vehicle insurance).

For these reasons, you should constantly fit with the protection degrees of your personal vehicle insurance coverage plan, and if you do not have an individual policy, you'll desire to spend for the liability protection used by the rental firm - credit. Content Disclaimer: Viewpoints expressed here are the writer's alone, not those of any kind of bank, bank card provider, airlines or resort chain, and also have not been examined, approved or otherwise endorsed by any one of these entities. vehicle insurance.

Photo: IJzendoorn/Shutter, Supply Take pleasure inthis short article? Share it with a good friend, All featured items as well as offers are selected individually and also objectively by the writer. The Originator might receive a share of sales by means of affiliate links in web content - low cost auto. In the rate of interest of complete disclosure, OMAAT gains a recommendation incentive for anyone that's authorized via a few of the below links - automobile. These are the ideal publicly offered deals (terms apply )that we have actually discovered for every product and services. Point of views expressed right here are the author's alone, not those of the financial institution, credit report card company, airline company, resort chain, or product manufacturer/service company, and also have actually not been assessed, approved or otherwise endorsed by any of these entities. In this article I desired to take a look at the basics of just how that works, and after that cover several of

the very best credit score cards to make use of when leasing cars and trucks. Just how does bank card rental auto protection work? A lot of us lease cars and trucks from time to time, and when we do, it can be difficult to choose what level of coverage to obtain. The reasoning is that lots of people have an insurance plan in the United States, which does not cover them abroad.

insurers laws vans auto

insurers laws vans auto

For a few additional dollars, you are waiving the capacity for the rental cars and truck firm(and also the rental car company's insurance business)to come after you if the vehicle is damaged or swiped. How Debt Card Insurance Policy Covers a Rental Auto When you pay for your rental cars Have a peek here and truck with a credit card, you obtain an added layer of insurance coverage. Due to the fact that you leased the car using your credit history card, your credit card rental car insurance policy acts as secondary coverage, covering any costs not covered by the main protection.

automobile auto cheap auto insurance cheapest car insurance

automobile auto cheap auto insurance cheapest car insurance

Leading 10 Credit History Cards for Rental Car Insurance Rental auto insurance policy coverage varies commonly between credit score cards. Some credit card companies provide powerful rental vehicle insurance protection. We have actually detailed the top 10 best credit history cards for rental auto insurance policy below.

Additionally verify how the coverage works if someone else is driving the car. Most protection through a credit history card reaches all drivers authorized by the car rental company, however you ought to inspect to be sure. What is covered? Which chauffeurs? What's left out? Whatever your choice, it's important to recognize what you spend for and also what you're eventually responsible for when leasing a cars and truck . Over the summer, Marbled participant Anna located herself in a sticky circumstance in South Carolina. After arriving in the Palmetto State to attend a wedding celebration, she rented out a vehicle to receive from Charleston Airport to her relative's residence. While Anna had visited her relative prior to, she had actually never ever driven these roadways herself, and certainly not during the night. For both of them, Anna pounded her foot on the brake. The deer limped off, and the auto was still drivable (dui). Unquestionably, the paint was a bit chipped and components of the fender seemed a bit looser than before."Lucky for me,"thought Anna," I have insurance policy with my credit rating card. "Yet was she in fact covered? Like Anna, a lot of us go around assuming our bank card will safeguard us monetarily when it pertains to the theft or damage of a rental cars and truck. Unsurprisingly, rental auto insurance coverage provided by a bank card isn't totally apparent. Off, it must be kept in mind that not all credit cards use rental insurance policy, and even if yours does, you may still have to opt in to the program. This might sound apparent, yet for the insurance policy to use, - affordable. The real number of days can differ, however it's worth checking out in development especially if you're planning a lengthy journey or taking a trip abroad. Each debt card has a somewhat different set-up, so similar to every little thing, it's great to check out

the great print. To aid you out, we took the liberty of taking a look at some of the most popular credit cards out there(based on internet search quantity )and also outlining the quantity they cover, along with the period of that coverage. An additional card company that supplies Primary Rental Vehicle insurance coverage is American Express. Its Premium Car Rental Securitypolicy is an optional add-on that supplies main protection for$19. 95 per$ 24. 95 per rental period, not daily, as well as it goes much past any various other card's Loss Damages Waiver coverage. State hi to Jerry, your new insurance policy agent. We'll contact your insurance policy firm, review your existing strategy, after that locate the insurance coverage that fits your demands and also conserves you money. You could rely on personal automobile insurance policy, as it may cover theft or damage of your rental cars and truck, but you must speak to your insurance provider to be certain you have this insurance coverage. Bank card rental automobile insurance coverage and also deductibles However, making a case on your individual insurance policy can lead to greater prices, and also the payment of a large insurance deductible. To cover these losses, you would certainly require third event responsibility insurance policy, which isn't an advantage of any type of charge card . Without third-party liability insurance, you might be liable for damages if you were filed a claim against by the various other driver as well as its occupants. This protection might be component of your personal car policyor it can usually be generally from acquired rental car company. Up until simply a couple of years ago, nearly every charge card came conventional with rental car insurance policy. One by one, lots of major credit report card companies began lowering its cardholder benefits over the last couple of years, consisting of the once common cars and truck service insurance (car insurance). The finest method to tell if your bank card still uses rental car insurance is to take a look at a document called the "Guide to Conveniences."This is a generally consisted of as a handout that's sent by mail with the card, as well as it's updated every now and then. If you can not discover the most current version online, it's not a negative suggestion to call your credit report card issuer to confirm that you have the most recent duplicate. Exactly how to ensure that you're insured With the rental car insurance policy supplied by some charge card, you need to be really careful to follow all the guidelines as well as constraints. You can utilize a discount promo code and still be guaranteed, however you can't pay for your service with airline company miles, resort points or bank card rewards, and also after that simply pay for some quantity of taxes and charges with a credit card, and also still be insured by its plan. Advertisements by Money. Ad, Obtain a vehicle insurance coverage that uses rental automobile compensation protection. If you can not provide evidence of automobile insurance coverage, the rental automobile company will typically require you to buy insurance coverage from them.

The Best Strategy To Use For What You Need To Know About Credit Cards And Rental Car ...

What isn't covered Next, you need to make sure to follow the regards to the rental agreement, as breaching it will certainly invalidate your insurance. The regards to your credit scores card rental insurance policy will normally omit numerous automobiles such as pricey high-end cars and trucks, vintages, big trucks and also full dimension traveler vans. cheaper auto insurance. A charge card's rental car insurance terms might additionally have territorial restrictions that limit the insurance coverage of automobiles leased in some nations. For instance. Rental auto insurance coverage if you don't have an auto You must also understand the distinction in between the burglary and also damage insurance coverage supplied by your bank card, as well as obligation insurance coverage that isn't. If your automobile is taken, or you obtain in an accident, your charge card policy will just cover losses up to the value of your rental automobile. This is why you should have a personal insurance plan that covers liability, or pay additional for responsibility insurance coverage provided by the vehicle rental business. What are key and second insurance coverage? Lastly, you ought to recognize the distinction between key and also secondary insurance coverage. Lots of credit cards provide additional insurance coverage, which needs you to initial send a claim with your insurance provider, if you have private electric motor lorry insurance policy.

cheapest vehicle insurance risks insurance

cheapest vehicle insurance risks insurance

What isn't covered Next, you need to ensure to conform with the terms of the rental agreement, as breaching it will invalidate your insurance. The terms of your credit scores card rental insurance will normally exclude numerous cars such as pricey deluxe automobiles, vintages, large trucks as well as full dimension guest vans. A charge card's rental cars and truck insurance policy terms might additionally have territorial limitations that restrict the protection of vehicles rented out in some countries. For instance. Rental vehicle insurance coverage if you don't own a car You should also understand the difference in between the theft and also damages insurance policy offered by your credit report card, as well as liability insurance coverage that isn't. If your automobile is taken, or you obtain in a mishap, your credit report card plan will only cover losses as much as the worth of your rental car. perks. This is why you ought to have an individual insurance coverage policy that covers responsibility, or pay additional for liability coverage provided by the auto rental business. What are key and also second insurance coverage? Finally, you must recognize the distinction in between key and also second insurance coverage. Numerous credit cards offer secondary insurance coverage, which needs you to very first submit a claim with your insurance provider, if you have exclusive automobile insurance policy.

What isn't covered Next, you require to be sure to follow the regards to the rental arrangement, as breaching it will certainly void your insurance policy. The regards to your charge card rental insurance coverage will usually omit several vehicles such as pricey luxury automobiles, vintages, big vehicles and full dimension traveler vans. A charge card's rental vehicle insurance terms may likewise have territorial constraints that restrict the protection of lorries rented out in some countries. For instance. Rental car insurance policy if you don't possess a cars and truck You should likewise recognize the difference between the theft and damages insurance coverage offered by your bank card, and also liability coverage that isn't. If your cars and truck is stolen, or you obtain in a crash, your bank card plan will only cover losses as much as the value of your rental car. This is why you should have a personal insurance plan that covers liability, or pay extra for obligation coverage used by the vehicle rental firm. What are key and secondary insurance? Finally, you should recognize the distinction in between primary and also second insurance. Many credit history cards offer second insurance policy, which needs you to initial send a case with your insurance provider, if you have personal automobile insurance.

https://www.youtube.com/embed/mvNpEPgW5sw

What isn't covered Next, you require to ensure to adhere to the regards to the rental contract, as breaking it will invalidate your insurance. The terms of your bank card rental insurance will normally exclude several cars such as expensive luxury vehicles, antiques, large vehicles and complete dimension passenger vans. cheap. A bank card's rental car insurance policy terms might additionally have territorial limitations that restrict the insurance coverage of vehicles rented in some nations. . Rental automobile insurance coverage if you don't own an automobile You must likewise comprehend the distinction between the burglary and also damages insurance policy provided by your charge card, as well as responsibility coverage that isn't. If your cars and truck is stolen, or you enter a mishap, your charge card policy will only cover losses approximately the worth of your rental cars and truck. This is why you ought to have a personal insurance coverage plan that covers responsibility, or pay additional for obligation coverage offered by the vehicle rental firm. What are primary and also secondary insurance? You must recognize the difference between main and secondary insurance coverage. Lots of credit cards use additional insurance policy, which needs you to very first submit an insurance claim with your insurer, if you have personal automobile insurance.

Things about Loss Of Insurance Coverage - Georgia Department Of Revenue

Driving document influence In some states, auto insurer are called for to inform the Bureau of Electric Motor Vehicles when you go down insurance policy or adjustment companies. Once you have a gap in cars and truck insurance, it may be kept in mind on your driving record. In some situations, your vehicle can even be confiscated or your license suspended.

Your supreme goal ought to be to keep your car insurance protection inexpensive and certified with state laws. Your best resource for keeping you guaranteed and protected is your regional representative. They are additionally the person to count on if you do wind up with a gap in coverage. Technique obligation Car insurance plan are cancelled for 2 primary factors: non-payment as well as driving offenses.

In case a gap has already taken place, some companies may likewise be able to renew your expired insurance policy if the plan has actually just been inactive for a few days - perks. Find out much more regarding how Nationwide can keep you shielded as a driver, risk-free as well as in conformity with the regulation - dui.

It can be stressful to obtain a vehicle insurance policy cancellation notice from your insurance company. It's unlawful to drive without insurance coverage in many states.

insurers cars trucks risks

insurers cars trucks risks

Your insurer can terminate your policy, however they have to supply written notice before they do. The quantity of time they have to give you varies by state (credit). If you have questions concerning plan cancelations, it's a great concept to talk to the division of insurance policy in your state.

It's usually since the danger you provide to the insurer has actually altered given that you applied. dui. Laws differ by state, however if your policy has held for even more than 60 days, there are usually just a few factors an insurance provider can cancel your policy mid-term. They might include: Insurance coverage is no various than any type of various other service you spend for.

Examine This Report about Massachusetts Billing Information - Safety Insurance

Instances consist of driving under the impact of alcohol or medications, having a lot of factors, and also having unpaid car park tickets. affordable auto insurance. If the state puts on hold or withdraws your certificate, your insurance company normally can cancel your policy (insure). If you were identified with a clinical problem that makes it unsafe for you to drive, the insurance firm may be able to cancel your policy.

Depending upon the circumstances, they might agree to reassess. If they won't, you should begin purchasing brand-new coverage as soon as possible - insurance companies. You can start your search with traditional insurance firms. But if you're unable to find insurance coverage, you might Home page need to check with companies that focus on insuring high-risk drivers.

Insurers that join these swimming pools need to approve vehicle drivers the state designates to it, despite just how much of a threat they present. No matter where you obtain insurance coverage, you don't intend to let your plan gap due to the fact that it could leave you exposed to economic losses if you're in a crash (insurance company).

It's normally less complicated to have the policy restored if you're within the grace duration and it hasn't lapsed. If your policy has lapsed, it'll be tougher. The guidelines for reinstatement differ by insurance company, so it may be worth a phone call to your insurance firm. If you got a car insurance cancellation notification due to the fact that you haven't paid the costs, call your insurance firm today.

If the insurer accepts renew your policy, you may need to sign a form that states you didn't experience any losses during the grace period. And you concur not to submit any type of claims with the insurance provider from events that happened during that time. Having the insurance company renew your policy is generally the finest choice since you keep continual coverage, as well as you don't need to look for a brand-new plan.

Do not offer your state a reason to put on hold or revoke your permit. Careless driving as well as driving under the impact of medications or alcohol aren't the only infractions that might result in the suspension of your certificate. affordable car insurance. Your state might also put on hold or withdraw your permit for not appearing in court, not paying penalties, leaving the scene of a mishap, and extra (low cost auto).

Car Insurance Cancellation For Non-payment - Michigan Auto ... Fundamentals Explained

accident cars cheap insurance affordable

accident cars cheap insurance affordable

There are several different reasons why insurance coverage may be canceled (auto insurance). What Occurs If My Cars And Truck Insurance Is Cancelled Fee To Non Payment? If you have not paid your insurance policy costs by their due day after that you run the danger of getting your car insurance coverage terminated.

car insurers affordable vehicle

car insurers affordable vehicle

If you recognize that you are mosting likely to be late with your insurance payment you can call your insurance coverage supplier to see if there is a poise period or if something can be functioned out - vehicle. Some insurance provider will be lenient with one late settlement, but beyond that, they will typically terminate your insurance coverage for non-payment (cheap insurance).

You ought to receive a letter from your insurance coverage company that will plainly state which it is. This will come when it's time to restore your insurance policy and the insurance company is decreasing to restore your present policy.

low cost automobile cheap car cheap car insurance

low cost automobile cheap car cheap car insurance

Just How Lengthy Does Non-Payment Remain On Insurance Policy? If you have had your insurance coverage terminated since of non-payment it will certainly remain on your Insurance record for a duration of 3 years.

Some insurance provider might maintain risky prices longer than three years - car insurance. It is up to the insurance policy firm to establish its rates. Can I Obtain Automobile Insurance Policy If My Policy Was Cancelled? Yes. You might also be able to obtain insurance from the very same firm that initially terminated your policy.

If they were to insure you after that you would certainly be guaranteed as a risky insured. Which would certainly suggest that the premiums would certainly be a lot greater. A more likely opportunity would be to be guaranteed by an Insurer that specializes in high-risk insurance. Which once again suggests you would be paying greater costs.

The Ultimate Guide To Non-payment And Insurance Cancellation Affect Insurance Rates